Smarter Debt Management.

Smarter Investments.

Balncy leverages AI to deliver personalized debt-saving strategies and intelligent investment suggestions, helping you optimize your finances effortlessly.

Are You Making These Costly Financial Mistakes?

Millions of Indians are trapped in debt cycles, missing investment opportunities, and losing thousands annually due to poor financial coordination.

Struggling with Multiple EMIs

Real scenario:

Rohit has 2 personal loans, a home loan, and a car loan. He pays ₹35,000/month in EMIs, but his outstanding debt is barely decreasing.

Missing Investment Opportunities

Real scenario:

Anita focuses only on repaying debts and ignores her SIPs and employer Provident Fund contributions.

No Clear Financial Strategy

Real scenario:

Vikram switches between debt repayment methods and random investments without a clear plan, unsure if he is maximizing savings.

Why Choose Balncy for Your Financial Journey

We're building a comprehensive debt management platform that helps you take control of your finances with smart tools and clear insights

Time-Saving Tools

Automated debt tracking and payment scheduling

Interest Calculator

See exactly how much interest you can save

Investment Guidance

Learn when to invest while paying off debt

Goal Setting

Set realistic financial milestones and track progress

Smart Suggestions

Get personalized tips based on your debt profile

Secure Platform

Your financial data stays private and protected

Quick Setup

Get started with your debt plan in minutes

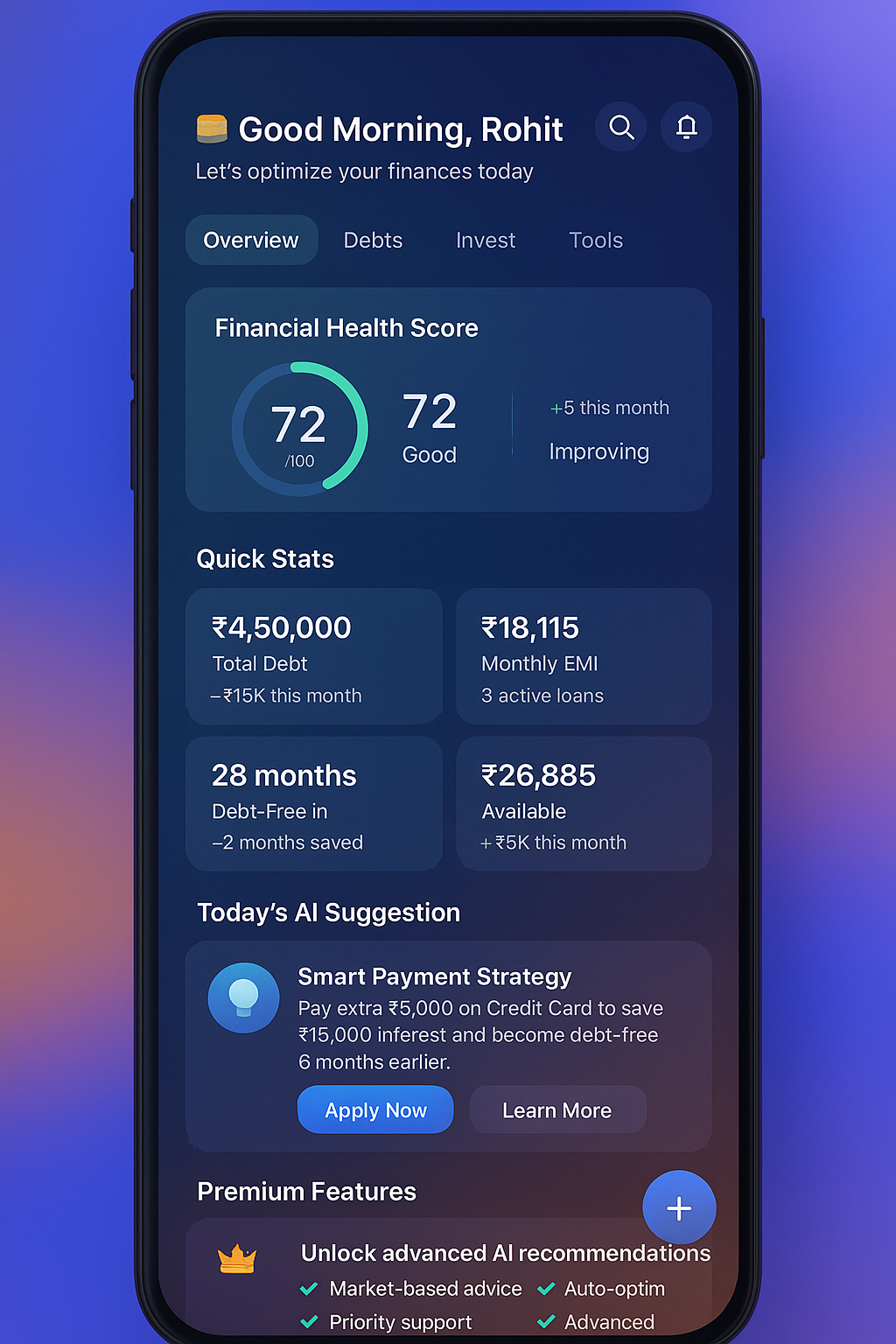

All-in-One Dashboard

View all your debts and progress in one place

AI-powered Debt Management

Advanced algorithms analyze your spending patterns and debt structure to create personalized payoff strategies that save you thousands.

Smart Investment Recommendations

Get AI-driven investment suggestions tailored to your risk profile and financial goals while you pay down debt efficiently.

Data Security

Your financial data is protected with the same security standards used by major banks.

Personalized Experience

Every recommendation is tailored to your unique financial situation and goals.

Everything You Need to Succeed Financially

Balancy combines powerful debt management with intelligent investment planning to give you complete control over your financial future.

Track & Reduce Debt

Smart debt tracking with personalized payoff strategies to eliminate debt faster.

Investment Planning

Create personalized investment portfolios based on your risk tolerance and goals.

Financial Insights

Get AI-powered recommendations and insights to optimize your financial decisions.

Secure & Private

Bank-level security ensures your financial data is always protected and private.

Intuitive Interface

Clean, user-friendly design that makes financial management effortless.

Goal Achievement

Set and track financial goals with visual progress indicators and milestones.

How It Works

Get started in three simple steps and transform your financial future

Add Your Debts & Investments

Connect your accounts or manually input your financial information. Our secure platform handles everything with bank-level encryption.

Get Expert Recommendations

Our AI analyzes your financial situation and provides personalized strategies for debt payoff and investment opportunities.

Track Progress & Reach Goals

Monitor your progress with beautiful dashboards and celebrate milestones as you achieve your financial objectives.

Be Among the First to Experience Financial Freedom

Join our early access list and enjoy exclusive benefits when Balancy launches.

Free Premium Access

3 months of premium features at no cost

Priority Support

Direct access to our financial experts

Exclusive Content

Weekly financial tips and market insights

Our Mission

"We're building a platform to help people take control of their debt, understand their financial options, and make informed decisions about their money."

Expected launch date

Focus on user experience

Committed to development

We're in development: Balncy is currently being built by a dedicated team focused on creating tools that actually help people manage their finances. Early access members will help us test features and shape the product to ensure it meets real user needs.

Join our journey to build something meaningful for your financial future

Frequently Asked Questions

Everything you need to know about Balncy and our development journey

Balncy is a debt management platform we're building to help you organize your debts, track payments, and create realistic payoff plans. We'll provide tools to calculate interest savings, set financial goals, and track your progress over time.

Still have questions?